HDFC LTD AR 2022

Digital is the new normal -

Evolving with trends is the culture that makes HDFC - Next HDFC.

Chairmen letter -

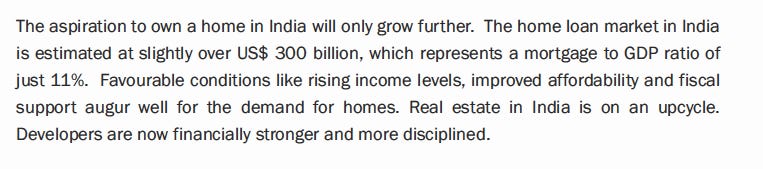

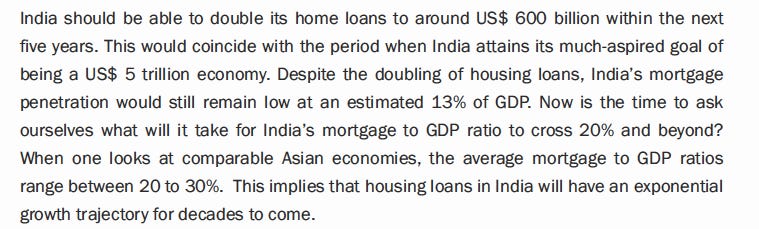

Views on market size and its potential:

We believe the primary reason mortgage to GDP is low in India is - renting is far more affordable than owning property in India. Due to black money in the real estate market people are ready to pay up & earn low rental yields which makes it harder for most to own the property.

With GST and the birth of new startup-organized businesses, this trend may change over time.

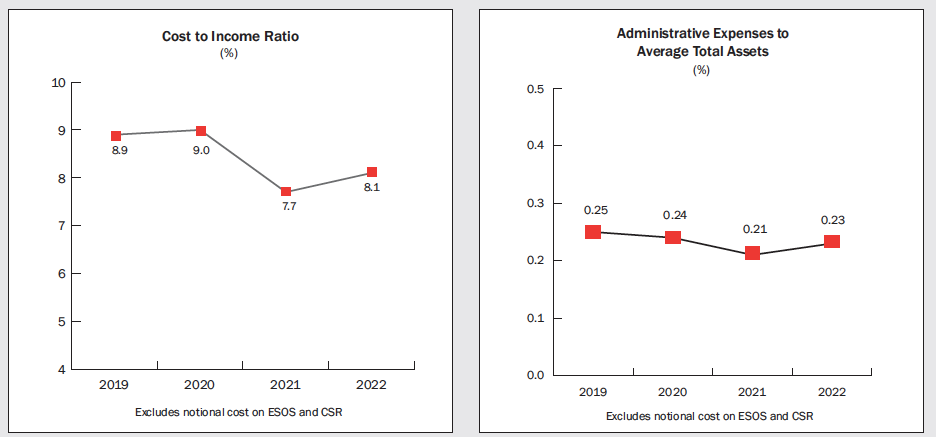

Insightful charts:

Cost to Income ratio has been on decline -

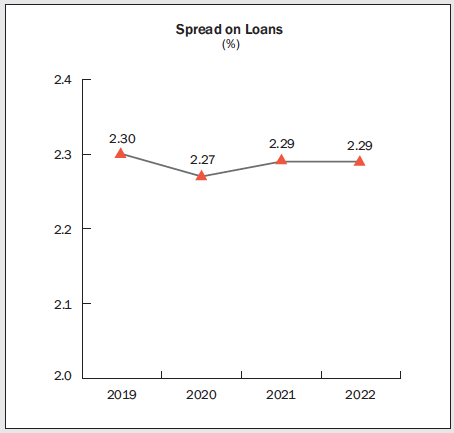

Spread on loans has been maintained -

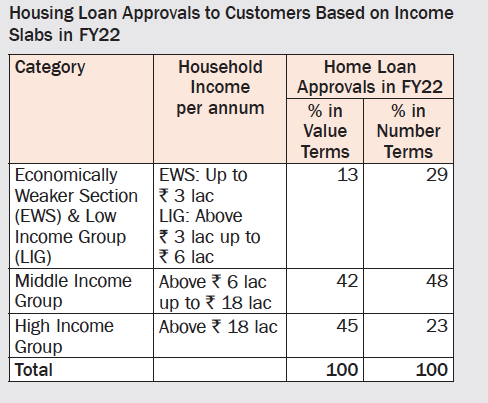

HDFC has been increasing its share in the affordable housing market too - 13% in value terms and 29% in a number of terms that have been issued to affordable housing.

The average home loan to the EWS and LIG segment during the year stood at Rs 11.2 lac and Rs 19.7 lac respectively.

Moreover, the Rural housing loans accounted for approximately 8% of outstanding individual loans. How tech helping them expand in the Rural market as they can do real-time analysis of crop production -

On AUM:

On an AUM basis, the growth in the individual loan book was 17%. The growth in the total loan book on an AUM basis was 15%.

More digital underwriting -

In non-individual loans, even HDFC Ltd is touching NPL north of 5%, which kind of explains why PEL is struggling by solely focusing on this market - they still report having a gross NPA of 4% which could be underreported.

No other NBFC in the market can match the borrowing profile of HDFC Ltd -

Productivity Matrix -

Subsidiaries of HDFC LTD: